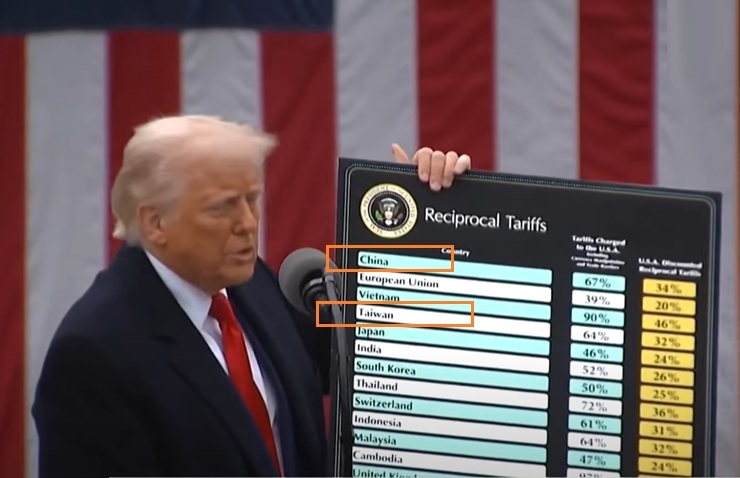

BEIJING/WASHINGTON (Reuters) -U.S. President Donald Trump's stunning decision to pause the hefty duties he had just imposed on dozens of countries sent battered global stock markets surging on Thursday even as he ratcheted up a trade war with the world's No. 2 economy China.

Trump's turnabout on Wednesday, which came less than 24 hours after steep new tariffs kicked in on most trading partners, followed the most intense episode of financial market volatility since the early days of the COVID-19 pandemic.

The upheaval erased trillions of dollars from stock markets and led to an unsettling surge in U.S. government bond yields that appeared to catch Trump's attention.

"I thought that people were jumping a little bit out of line, they were getting yippy, you know," Trump told reporters after the announcement, referring to jitters sportpeople sometimes get.

U.S. stock indexes shot higher on the news, with the benchmark S&P 500 index closing 9.5% higher, and the relief continued into Asian trading on Thursday with Japan's Nikkei index surging 8%.

European futures also pointed to big gains, but there were already signs the rally may be short-lived with U.S. stock futures trading lower.

Hopes of state support helped prop up Chinese stocks, although its yuan currency fell to its weakest level since the global financial crisis.

Since returning to the White House in January, Trump has repeatedly threatened an array of punitive measures on trading partners, only to revoke some of them at the last minute. The on-again, off-again approach has baffled world leaders and spooked business executives.

U.S. Treasury Secretary Scott Bessent asserted that the pullback had been the plan all along to bring countries to the bargaining table. Trump, though, later indicated that the near-panic in markets that had unfolded since his April 2 announcements had factored in to his thinking.

Despite insisting for days that his policies would never change, he told reporters on Wednesday: "You have to be flexible."

But he kept the pressure on China, the second biggest provider of U.S. imports. Trump immediately hiked the tariff on Chinese imports to 125% from the 104% level that kicked in on Wednesday.

Chinese companies that sell products on Amazon are preparing to hike prices for the U.S. or quit that market due to the "unprecedented blow" from the tariffs, the head of China's largest e-commerce association said.

Beijing may again respond in kind after slapping 84% tariffs on U.S. imports on Wednesday to match Trump's earlier tariff salvo. It has repeatedly vowed to "fight to the end" in the escalating trade war between the world's top two economies.

"The U.S. and China are currently in a powerplay game of brinkmanship," said ING global head of markets Chris Turner.

'GOADED CHINA'

Trump's reversal on the tariffs imposed on other countries is also not absolute. A 10% blanket duty on almost all U.S. imports will remain in effect, the White House said. The announcement also does not appear to affect duties on autos, steel and aluminum that are already in place.

The 90-day freeze also does not apply to duties paid by Canada and Mexico, because their goods are still subject to 25% fentanyl-related tariffs if they do not comply with the U.S.-Mexico-Canada trade agreement's rules of origin. Those duties remain in place for the moment, with an indefinite exemption for USMCA-compliant goods.

Trump's tariffs had sparked a days-long selloff that erased trillions of dollars from global stocks and pressured U.S. Treasury bonds and the dollar, which form the backbone of the global financial system. Canada and Japan said they would step in to provide stability if needed - a task usually performed by the United States during times of economic crisis.

Analysts said the sudden spike in share prices might not undo all of the damage. Surveys have found slowing business investment and household spending due to worries about the impact of the tariffs, and a Reuters/Ipsos survey found that three out of four Americans expect prices to increase in the months ahead.

Goldman Sachs cut its probability of a recession back to 45% after Trump's move, down from 65%, saying the tariffs left in place were still likely to result in a 15% increase in the overall tariff rate.

Treasury Secretary Bessent shrugged off questions about market turmoil and said the abrupt reversal rewarded countries that had heeded Trump's advice to refrain from retaliation. He suggested Trump had used the tariffs to create maximum negotiating leverage. "This was his strategy all along," Bessent told reporters. “And you might even say that he goaded China into a bad position."

Bessent is the point person in the country-by-country negotiations that could address foreign aid and military cooperation as well as economic matters. Trump has spoken with leaders of Japan and South Korea, and a delegation from Vietnam met with U.S. officials on Wednesday to discuss trade matters, the White House said.

Bessent declined to say how long negotiations with the more than 75 countries that have reached out might take.

Trump said a resolution with China was possible as well. But officials have said they will prioritize talks with other countries.

"China wants to make a deal," Trump said. "They just don't know how quite to go about it."

Trump told reporters that he had been considering a pause for several days. On Monday, the White House denounced a report that the administration was considering such a move, calling it "fake news."

Earlier on Wednesday, before the announcement, Trump tried to reassure investors, posting on his Truth Social account, "BE COOL! Everything is going to work out well. The USA will be bigger and better than ever before!"

Later, he added: "THIS IS A GREAT TIME TO BUY!!!"

(Reporting by Reuters newsrooms; Writing by Andy Sullivan, James Oliphant and John Geddie; Editing by Nick Zieminski, Matthew Lewis and Lincoln Feast)

News magazine bootstrap themes!

I like this themes, fast loading and look profesional

Thank you Carlos!

You're welcome!

Please support me with give positive rating!

Yes Sure!